Tax Prep is a Pain in the Bum

I’m going to admit something here. Lean in because it’s not something that I’m really supposed to be saying — you know, since I help businesses with their financial strategy and everything. Ready?

Tax prep is a headache!

Don’t get me wrong. I really do love keeping things organized for the sake of efficiency and making better financial decisions, BUT when it comes to preparing for taxes, there are so many little, tedious pieces, and those pieces often change based on the current political stakeholders (like now). Not only is it hard to keep up with where you and your business are going to fall in the tax cluster(f*$k), but all the pieces and players are very different than what you will encounter on a daily/weekly/monthly basis. It’s confusing! The rules are their own, and there is no hiding.

But like really, don’t try to hide. Taxes are not something you can ignore. I’ve worked with many-a-business owner who have thought that can avoid payments or “game the system”, or simply don’t plan appropriately and then end up paying back-taxes … A LOT of back taxes.

LOL — no, don’t give up. Truth be told, I’ve waiting for an excuse to use that gif. Love me some SoR!

So really, what do you need to know

to get organized for taxes?

There are three main areas to prep for your business that you will give your tax accountant come tax time.

…yes, I do recommend hiring a tax accountant. They will pay for themselves in the headache alone. They know all the rules, write-offs, and processes to keep the most money in your pocket.

…and yes, even if you do hire a tax accountant, there is still A LOT of work to do on your end. The more you organize, the more time you will save your accountant, and the more money you will save yourself.

(1) Categorize your expenses

This is the main, most obvious part of business tax prep. It’s the thing that gets talked about the most and is also one of the most tedious. Every business owner knows that there are expenses that you need in order to be able to run your business. The IRS allows you to write-off all these expenses so that you don’t have to pay taxes on the money that’s necessary to keep your business running.

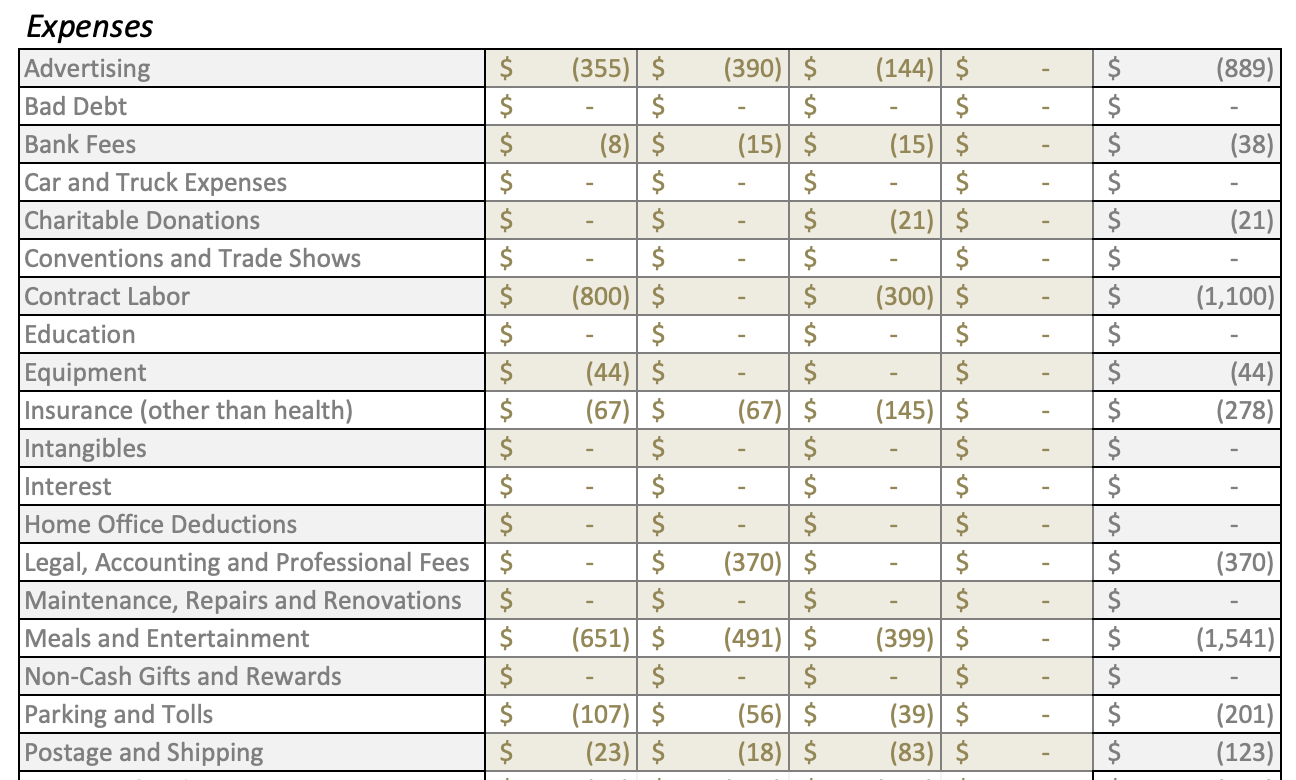

I have a list that I have compiled from what I know are tax deductible expenses that apply specifically to my business; things like advertising, insurance, meals/entertainment, rent, supplies, travel (flights and rental cars), etc. Each month I copy and paste a csv file from my business banking accounts, categorize each expense, and compile the categories for the whole year. I have never used an accounting software because I have systematized everything in excel and it literally takes me 30 minutes to do an entire year’s worth of expenses. That being said, there are a handful of great programs that will connect with your bank account and automate some of the categorizations for you (i.e. Quickbooks, Wave, etc.). The downside is that they don’t organize the categories for you, meaning they don’t put all the travel expenses together, so you still end up having to do a fair amount of maneuvering and organizing.

Below is an example of the category breakdown by quarters and added up for the total year:

Your tax accountant will generally only care about the total annual amount, but the quarterly breakdown is important if you are filing quarterly taxes and/or you want to see how your expenses unfold throughout the year to better prepare you forecast for upcoming annual expenses.

As your company grows and your expenses start to vary, this type of bookkeeping may be something that you want to hire out. With small, solo-entrepreneurial companies, it’s fairly easy and straightforward to go through each expense, but once the expenses pile up, it can take more time than it’s worth.

Another thing to note about expenses is that there are going to be some large purchase items — things that are not regular or ongoing expenses. These are called capital expenses (i.e. equipment, buildings, vehicles, land, equipment, etc.). For a photography business, that means things like camera gear or purchasing (not renting) a new studio space. Capital expenses will be used to deduct a portion of the expense annually depending on the overall depreciation of the new asset <— that’s a lot of accounting speak for spreading out the tax deduction into multiple years instead of the one year that the large purchase was made.

(2) Track your mileage

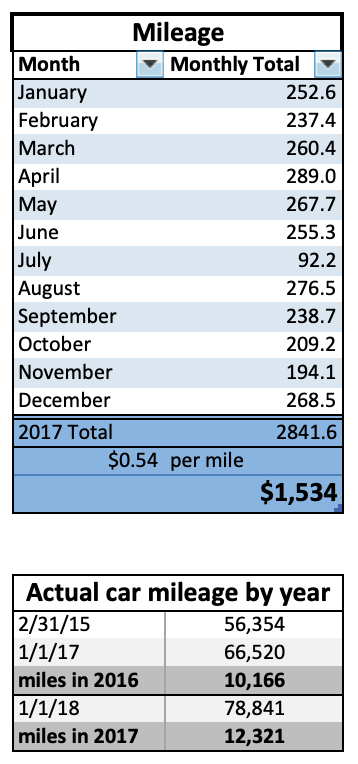

2018’s mileage rate is 54.5 cents per mile. This means that for every business specific mile you drive on your car, you can write-off a little over 50% of the equivalent dollar amount. This accounts for both gas and wear and tear on your personal/shared vehicle.

Gone are the days of google mapping all of the appointments and meetings on your calendar from the past four months. Ain’t nobody got time for that! There are a handful of apps that track your ‘to and from’ (i.e. Mile IQ). Keeping it on your phone is an easy way to track and automatically add your business specific trips. The miles to and from add up quickly, so it’s helpful to have something that’s automatic so you don’t have to go back and do all that work yourself. Another benefit is that it’s auditable — meaning that years from now, you are able to go back and review the specific category that each trip fell under if you should need to.

Again, I use excel to compile all the data from my app. The app will give you the totals for each month and year, so you could just give that number directly to your accountant, but I like to have it all in one document. To do that, I download the csv file from the app, copy and paste it into an excel document that I’ve created, and it automatically tallies the mileage for each month and then for the total year. Similarly to the above expenses, my accountant only needs the annual mileage, but I like to see the breakdown so I can compare it to year’s past and better project the coming year.

One more thing to note here, tracking mileage is one way to write-off mandatory car transportation; however, if you are only using your car for work purposes, you can also fully lease the car and pay for gas with your business account. If that’s the case, car expenses will be an additional category in the above explanation. You can see in the example above that business mileage only makes up about 23% of total transportation, so it wouldn’t make sense to pay for the entire car’s expenses with business funds.

(3) Tally shared expenses

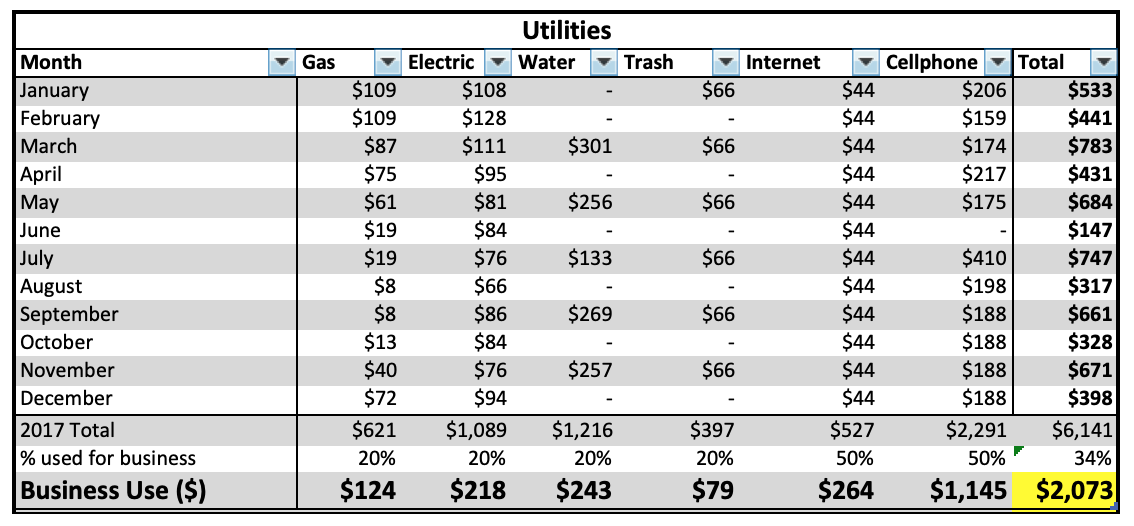

This section is primarily for those that have a home office. If you work from home, you will have some shared expenses (utilities, phone, cleaning, trash, etc). You can write off a portion of these shared expenses on your taxes. For the utilities, you will need to actually measure the percentage of square footage that your home office takes up in comparison to your house as a whole. If it takes up 20% of the total square footage, you are able to write-off 20% as a business expense.

All of these utility expenses are those that are paid with a personal account but are shared for business use. The percentage will depend on family usage, ratio of square footage used for business, and overall business vs personal usage.

Above is a sample of how I have tracked each personal bill (for 2017) that is also used for business use. Each time I receive an invoice from a personal bill, I type it in to this sheet. At the end of the year, my accountant uses the total amount. If I needed to show details as to why the total amount is where it is, I will pull-up this table and show in detail each expense by month and usage.

So there you have it; a detailed account of what is needed to prep to file your business taxes. Many of my new clients, this seems like overkill at first, but the reason for detail is two-fold. (1) Should you ever be audited, the more detail, the better. The detail will help to underline the legitimacy of each expense, as well as help jog your memory for each event/expense in question. And, (2) all of these trackers will also help you to make better business decisions. Maybe you run your mileage and realize you spend 85% of your travel time on business travel. At that point, it’s probably worth it to switch to a business car lease …but you may not know that without seeing the numbers in front of you.

It may be a headache, but it hurts much less than pay those back-taxes, and I promise it’s worth it.

…like a tiny tinge vs. a gaping head wound.

If you’re looking to create some trackers that are specific to your business, give me a holler, and also be on the look-out for a few upcoming on-line classes — one of which will go over financial strategy for businesses.